Wise Review – 7 Must Knows

Launched in 2010, Transferwise was originally a service for international money transfers. They changed their name to Wise in 2021 to reflect their broader range of financial services which now also includes a multi-currency account and travel debit card.

Together you can easily and inexpensively do almost everything in 40 currencies and they are available in 160 countries. Apart from transfers, you can do things like hold multiple currencies in various wallets, generate virtual bank details for many countries (to get paid without opening a bank account), and pay by card anywhere in the world in your preferred currency.

Ultimately, Wise is a great solution for travelers, digital nomads, expats, immigrants and basically anyone who needs to manage their money across borders.

But, Wise is not always the best solution for some things and despite using them personally for many years, I don’t use them for everything.

In this Wise Review, I am going to focus on Wise as a whole including some specifics for money transfers.

Pros

- Highly rated by 3rd party review sites

- Available in the US, Canada, UK, Eurozone, Australia, New Zealand

- Send money to over 160 countries

- Transparent and low fees

- Available for both personal and business

- Offers a multi-currency account and Mastercard debit card

Cons

- No cash transfers

- Although Wise can transfer large amounts, you are generally limited to support via email up to £80,000 (or equivalent to approximately $96,000 USD, $144,000 AUD)

Jump Links

1. What Is Wise?

For many people, Wise is replacing many things banks did – like getting paid and paying for things in multiple currencies in addition to transferring money but because they are not an actual regulated bank they often do things better and cheaper because they are far more efficient.

On the other hand, they are still regulated in many countries and that means they have a different set of challenges.

2. How Wise Works

2.1 Money Transfers

Many services are able to transfer money, but Wise is a step up in many ways. As expected, you can make international money transfers (click to check details for your country) to your accounts or to third-party accounts.

Where Wise stands out is not just its low fees but its excellent user experience. For example, you can link your bank account to Wise for one-click transfers. This seemingly small feature makes transfers much easier and quicker than their competition. And if that doesn’t appeal, you can still make manual bank transfers to a Wise account in your country. In fact, they give you lots of ways to fund transfers including credit cards which you won’t find with many other providers.

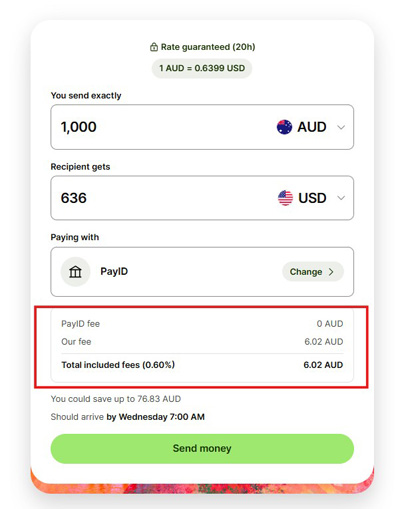

And you can manage your transfers through the Wise app online. Simply choose your two currencies and enter either the amount you want to send or the amount that the recipient should receive. Wise will make the calculations based on the mid-market exchange rate and show you the exact fee (Usually 0.39% – 2.5% of the amount in total fees). When you accept, this rate is locked in for a set period of time depending on the country where you are sending the money from.

Then their system tracks exactly where your money is and notifies you by email and online.

2.2 Managing Multiple Currencies

When you join Wise, you are automatically eligible for a multi-currency account which is free. When you open the Wise app, these will appear as currency wallets with options to add, send, and convert money, and even set up direct debits. You can also open Jars within your wallets to separate money into different pots.

While you can open wallets in any of the 40 currencies that Wise supports, there are ten currency wallets that also provide you with a valid local bank account number. These currencies are AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY, and USD. You can use these wallets as a local bank account for that country. For example, if you are in Australia on a working holiday visa, you can use your Wise AUD account to receive your salary. If you are a freelancer working for a US company, you can use your Wise USD account for accounts receivables.

For more information on how the this works check out our review of the Wise multi currency account.

2.3 Easy Spending in Foreign Currencies

Finally, you can also request a Wise travel debit card, managed by Mastercard, to spend what you hold in your Wise wallets. It can also work like a travel money card if you create a wallet for the country you intend to visit.

Physical cards are currently only issued in a handful of countries. For a fee of around £7, you can receive a physical card if you have an address in Australia, Belgium, the EEA, Brazil, Canada, Japan, Malaysia, New Zealand, the Philippines, Singapore, the United Kingdom, and the United States. You can get virtual cards for NFC payments that work within the Wise app, or with Google Pay or Apple Pay anywhere in the world.

In most cases, it is significantly cheaper to spend with your Wise card in the local currency than using your international debit or credit card. This is because the conversion fees to the local currency are generally far higher when you use the cards banks issue.

And since the Wise Travel debit card is linked to your multi-currency account, you have a lot of flexibility. For example, you could use the card for AUD while in Australia, and use the same card to spend in New Zealand or Indonesia or wherever.

However, there are limits on how much you can spend before you start to pay fees. These vary based on the country and currency. In Australia, you can withdraw up to AUD 7,000 per month in cash and your monthly spending limit on other types of transactions is AUD 52,500.

For more information on how the card works check out our review of the Wise travel card.

3. When Wise Doesn’t Work

Wise is much cheaper and far better at many things compared to traditional banks – but while keeping your cost low through efficiency they lose a few things.

3.2 Frozen accounts

One of the main challenges every money transfer company faces is the need to meet regulations in multiple countries where they operate. In general regulation is good thing because there are safeguards in place for your money. However what this means is that accounts can get frozen while you provide additional ID or documents. This is usually not an issue, but can take time to resolve.

3.1 For smaller transfers limit communication

If you transfer money less than equivalent £80,000 (or equivalent $96,000 USD, $144,000 AUD) then you are limited to support via email.

This can create challenges if you have issues with your ID, or you set up a transfer and exceed the transfer limits your bank has (which are usually much lower than £80,000). In these scenarios, it can take days to sort out issues that would otherwise take minutes by phone.

That being said, one of the reasons why they offer such low fees is because they limit communications and for the most part this is an advantage.

If you need larger transfers, check out OFX review and our Wise Vs OFX comparison.

Wise Scorecard: Overall Rating 4.7/5 Stars

We are giving Wise an overall 4.7 star rating for anyone who needs to transfer smaller amounts or works with multiple currencies. And to justify this rating, let's look at the four things most users are interested in: rates and fees, transfer speeds, trustworthiness, and reviews.

4. Wise Rates and Fees (5/5)

First and foremost, Wise is fully transparent with its rates and fees. This is consistent with their stated mission of: “building money without borders: moving it instantly, transparently, conveniently, and – eventually – for free”.

Starting with the exchange rate, you get the mid-market rate that tracks actual exchange rates. This means that you will get far cheaper rates than banks and other services, which “build in” some of their fees.

Try as you like, I have been hard-pressed to find total costs lower than Wise.

Wise’s transfer fees are also low, usually set as a percentage of the amount you are sending, starting at about 0.39% and averaging 0.65%. The exact rate depends on the currencies.

We give Wise 5 of out 5 for this because not only will you struggle to find lower fees anywhere else, we have seen the fees reduce year on year which is exactly what they set out to do. To back this up they also produce a quarterly mission statement which is unique in the money transfer world.

5. Wise Transfer Speeds (5/5)

In about 60% of cases, international money transfers are instant, though they can take up to five days. For most people transfers take seconds or minutes which is much than between bank accounts, which generally take at least a few days at a minimum.

Ironically any slowdowns with Wise occur because of how long it takes local banks to process transactions.

For example, my slowest transactions tend to be when I send money to Australia, and it seems to relate to the time difference and local bank operating hours. However, while international bank transfers can take several hours to get to Wise when I send money from Wise to the Australian bank account, the transfer is always instant. This is because the first transfer uses the SWIFT system, while the latter uses Australia’s faster PayID system.

Regardless of the countries you are transferring between, Wise will usually give you multiple options with the corresponding speeds shown.

On occasions, transfers will take longer. The app will show that your money has been received by Wise but has not yet been paid out.

We give Wise 5 of out 5 again for speed because they are best in class when it comes to speed, like fees transfer speeds has been a focus for Wise and they consistently deliver faster speeds each year. Sure you may find faster speeds but generally you will pay significantly higher fees. Once again, check out their quarterly mission statement for the details.

6. Wise Trustworthiness (4.5/5)

Wise was the first FinTech company listed on the London Stock Exchange and now has 16 million customers that transfer more than £100 billion annually. While they are not a bank and therefore do not provide the same protection as a bank, they only hold their money with established financial institutions. Client funds are ring-fenced and safeguarded separately from Wise’s internal funds, so in theory, you shouldn’t lose your money even if Wise becomes insolvent.

Wise is regulated in 14 countries including Australia, Belgium and the EEA, Brazil, Canada, Hong Kong, India, Indonesia, Israel, Japan, Malaysia, New Zealand, The Philippines, Singapore, the United Kingdom, and the United States.

Wise uses HTTPS encryption and a two-step login process to protect data. The company says it will never “misuse” or sell customer data. Wise’s anti-fraud team constantly monitors for any anomalies and attacks. They run regular vulnerability scans and use independent auditors for internal and external penetration tests and other security scans.

For us Wise is exceptionally trustworthy, the only reason we marked them down slightly to 4.5 out of 5 is due to the relatively limited contact options you get. Based on how quickly they are growing, it looks like almost everyone agrees that low fees are better than paying for expensive customer service.

7. Wise Reviews (4.3/5)

The Wise app is your gateway for managing everything in Wise, and it is highly intuitive and usable. Most users agree. Wise has 4.3/5 stars on TrustPilot from 215,000+ reviews and 4.7/5 in both the Google Play Store and Apple Store.

When you first join Wise you will need to confirm your identity. In most cases, this means uploading a photo of you with your national ID and providing proof of address. This only takes a few minutes, and you only have to do it once to unlock most of Wise’s products.

Once you have made a transaction, it is simple to send money to the same accounts with just a few clicks. If you want to, you can connect your bank account to Wise for one-click transfers, without the need to access your banking app.

Looking through reviews, the most consistent complaint from users is that front-line customer service is managed using AI. If you need to speak to a real person, you may find that this is quite difficult – if not impossible.

I’ve been using Wise for 6 years

I’ve been using Wise for 6 years. It is faultless in the speed and simplicity of converting funds from one currency to another. Having a Euro account through Wise means you get treated as local for all your transactions, From motorway tolls to your morning coffee. What’s more, I have used it in buying a property in Spain. When transferring significant amounts, it might take 20 mins while your transaction is approved, but it goes through and has been security checked. Frankly, one of the most important apps on my phone.

-Mr. Marcial Doporto

Trustpilot

The great exchange rate you get on…

The great exchange rate you get on currencies. Way better than the banks here in Australia. The banks had plenty of time to fix, they took us for what they could. I do long holidays so for me the exchange rate is important, the WISE rate leaves me $100's more in my pocket.

-Perry S

Trustpilot

Transfers made easy

For me, it is easy to transfer money to Thailand takes seconds or minutes not like my UK bank took 10 days and a expensive phone call back to my bank

-MR J TAYLOR

Trustpilot

Bottom Line

If you travel frequently or send or receive money from abroad often, Wise is an excellent tool to manage your personal finances. Their range of international money services covers most of what travelers, digital nomads, and international freelancers need to manage their money across borders. You can manage it all in the easy-to-use, transparent, and secure Wise app.

Wise offers some of the lowest rates for international money transfers and overseas spending. While they might always be the absolute cheapest option for every transaction, they are consistently among the most affordable and you can use them without fear of being overcharged.

I personally use Wise to move money between my international bank accounts, to get paid by clients in countries where I don’t have standard bank accounts, and for spending when I’m on the road. I highly recommend Wise.