TorFX Review

I’ve first used TorFX for over a decade now, and even in 2026, I’m still happy to report that they still prioritise individual needs over automation.

To be honest, I was skeptical at first. They don’t follow the standard money transfer guidelines, which is why I always tell my friends, ‘You’re either going to love them or hate them.’ It all depends on what you value in a service.

Originally founded in the UK and now operating across Australia and New Zealand, TorFX is built for the expat and retiree market.

When I first signed up, I actually found it a bit confronting that they asked so many questions – like exactly how much money I planned to move and when. But there are some great benefits to them going the extra mile.

You see, while the rest of the industry is quickly embracing AI and chatbots to save every last cent, TorFX has remained consistent on human connection and creating solutions rather than just focusing on each transfer. Sure, they can structure complex transfers, but the best bit is that you have the name and number of someone who you can work with and this can help sort out any potential issues or questions that crop up.

But like I said, they aren’t the best fit for everyone.

While TorFX maintains a near-perfect 4.9/5 rating on third-party sites largely because they don’t try to be everything to everyone. For example, if you’re just sending a few hundred dollars or a small one-off payment, you’re better off with a service like Wise. With Wise, you can do everything online and usually save money on smaller amounts. And if you really prefer being able to do almost everything online then OFX is TorFX’s closest competitor.

My goal with this review is to help you figure out if you’re the ‘perfect fit’ for TorFX or if you’d be better served elsewhere.

Pros

- Top-notch customer support – especially valuable for larger transfers where it really matters

- Low-costs (with best rate guarantee)

- High reliability through a dedicated account manager

Cons

- Customer support can be phone-heavy (a plus for some, a drawback for others)

- Not available in the US and Canada (see alternatives below)

- Less ideal for small transfers or cash pickups (see alternatives below)

Jump Links

1. Trust TorFX?

TorFX assigns a dedicated account manager to your transfers. It’s reassuring that they’ve been around for 20 years and cover 120 countries, but the real benefit comes when you’re dealing with the “messy” side of banks and regulations.

An account manager isn’t just there to be friendly (although that’s nice), it’s in their interest to pull your transfer through any potential problems with banks and regulations. Having used many different services while moving countries over the years, I’ve learned that a slightly better exchange rate means nothing if your funds get frozen and you’re stuck talking to a chatbot.

I’ve discovered firsthand how wrong things can go. I’ve spent days with a frozen account, wondering if I’d ever get my money back.

So while most companies rely on automated messages and next day emails to fix these issues, which is incredibly stressful when your life savings are in limbo.

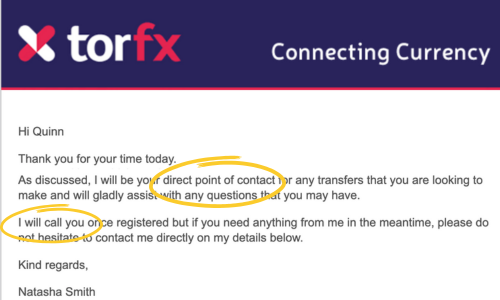

This is exactly where TorFX differentiates itself. As you can see in this screenshot above, they actually reach out to you. Having a human partner who is responsible for your specific situation – from the initial setup to each transfer – gives you a level of peace of mind you just won’t find at this level anywhere else.

Ultimately, the choice is yours, but the 4.9/5 star reviews show that people who use them tend to love the service.

Some of the members in our team love them.

2. How TorFX Works

2.1 Money Transfers

It all starts with getting a quote (see screenshot) :

- AUS/NZ and Asia – Get a free Quote

- UK and Europe – Get a free Quote

This is a great starting point because you can immediately see how they work and if you like them.

After getting a quote you can set up and manage your transfers through the TorFX app or by phone. Although larger transfers above $50,000 AUD will require you to speak to your “account manager” I found this to be quick and easy.

By working with your dedicated account manager you can also plan out your transfers.

What I found is that unlike online focused services – the personal account managers make it ideal for clients who value human interaction.

But there is a huge hidden benefit. Larger money transfers are notoriously complex and issues can occur (like issues with banks and regulatory issues) which can result in bad reviews for many of TorFX’s competitors. Not so with TorFX who is more able to address any issues before or when they arise.

2.2 Lock In Exchange Rates

For many TorFX clients who are making large or recurring transfers, TorFX offers the ability to lock in exchange rates.

These tools can save you money by allowing you to set a favourable rate, protecting against market volatility.

This feature could be especially useful for property buyers, business owners, or those paying international tuition fees, as it gives them more control over long-term exchange costs.

3. When TorFX Might Not Be the Best Fit

3.1 Small Transfers

TorFX Scorecard: Overall Rating 4.75/5 Stars

We're giving TorFX a 4.75/5 rating for its exceptional money transfer service, particularly for anyone making larger transfers (over $7000 USD which is $10,000 AUD/CAD or about £5500 GBP). Here’s a breakdown of what makes it stand out in four key areas: rates and fees, transfer speeds, trustworthiness, and usability.

TorFX may not be the best option for smaller transfers. While they offer competitive rates on larger amounts, and they don’t have a minimum to transfer the rate they offer may not be as competitive.

In any case there is no obligation to transact with them after you get a quote. If you do this, I recommend you check your quote against Wise (review).

For transfers below $7,000 USD ($10,000 AUD/CAD or £5,500 GBP), I personally just use Wise. Their fees are usually lower, transfers are often faster, and while they don’t offer telephone support, it’s rarely needed for smaller transfers. Wise also offers multi-currency accounts and cards, a feature that TorFX lacks.

3.2 Personal Account Managers

One of TorFXs greatest strengths may be a negative.

For many people, the personalised service you get is the MAIN REASON WHY you should use them. For others I believe the ability to do everything online as much as possible is more attractive.

However, there is a problem with doing things online that most people don’t fully understand. The problem relates to regulations, particularly for larger amounts and TorFX easily solves this problem by having a very hands-on service.

Don’t believe me? Check out the negative reviews from other money transfer services and ask yourself the question, “could this have been easily resolved by a phone call and someone at the other end who actually knows the industry?”

I think you will find the answer is almost always yes.

4. TorFX Rates and Fees - 4/5

One of the great things about TorFX is that you can get an obligation free quote and they consistently offer competitive rates, especially for large transfers.

I recommend you get one yourself if you are considering using them:

- AUS/NZ and Asia – Get a free Quote

- UK and Europe – Get a free Quote

It is obligation free and they also have a “Rate Improver Guarantee” which essentially means they will match or beat another services rate.

Also by working directly with an account manager, you can often secure a better rate than you would with online-only platforms because they look at the big picture in terms of volume of transfers. While fees can vary depending on the currency and amount, TorFX is clear about what you will pay when you get a quote online or by phone/email.

They also have no fees, the only way they can operate is by building a margin into the exchange rate. And they are quite competitive rates, starting at about 1.5% down to below 1% – a significant saving on banks while getting a much better service.

Why not 5/5 then?

Don’t get me wrong TorFX is competitive but for smaller transfers you can usually do better.

5. TorFX Transfer Speeds - 4/5

TorFX’s transfer speed is competitive, typically on par with or faster than traditional banks, though it will often not be a quick as for smaller transfers who offer many ways to fund the transfer and a strong network of banking partners.

As TorFX says,

“the amount of time a transfer takes can depend on the currency, destination and receiving bank, the funds should be in your account on the same day or within no more than two working days for more exotic destinations.“

TorFX

This is pretty typical for transfers but it doesn’t into account the amount of time it takes to fund the transaction which is a more fair way to compare transfer speeds.

If you take this into account, the whole process can take anywhere from the same day up to 5 days, depending on the country and bank systems involved.

This is pretty typical for large transfers though banks or other services but for its part TorFX is no slouch.

6. TorFX Trustworthiness - 5/5

TorFX has built a strong reputation for reliability, with over 20 years in the business and millions of clients.

They’re regulated in multiple countries, which in should ensure that your money is safe even if they go bust.

TorFX also likes to highlight that they have a Level 1 rating (the highest level of creditworthiness) from leading agency Dun & Bradstreet.

7. TorFX Reviews - 4.9/5

While banks struggle to get over 2 out of 5 and other money transfer companies who are considered to be the best score in the 4.3 – 4.5/5 range, TorFX has earned an impressive 4.9/5 star rating on TrustPilot from over 8000 reviews with just two percent of reviews being one star.

This two percent of one-star news does underline some of the things I have expressed in this article, on the whole it is pretty clear most people are extremely happy.

Many users find the account managers highly knowledgeable and supportive, making large, complex transfers a more comfortable experience.

Great customer service

Great customer service. This was the first time in a very long time, I called a company without being told by a bot to press the right option, and then wait because I was number 23 in the queue.

I actually got to talk to a real human being, who really cared, straight up. They couldn't be more helpful, and actually cared about ME. Not just my money.

The rates were very good. They were extremely efficient and fast.

-Thomas OConnor

Trustpilot

Brilliant service very good rates and always available

Friendly staff.

Question never left un answered, and usually in less than an hour in my experience.

Great rates of exchange compared to others.

Easy to use interface of your account and the transactions you make.

Personal account manager always available to help with any questions you may have.

I can not fault the service I have received.

-

Andrew

Trustpilot

Bottom Line

TorFX isn’t necessarily the best fit for smaller transfers where a highly transparent online service like Wise might be more appropriate.

However if you’re looking to make large money transfers, TorFX is an excellent solution. Their hands-on support ensures transfers go smoothly which make them a standout choice if you need to transfer large sums or prioritize customer service.

Their combination of competitive rates and high-touch service is ideal for buying property, managing overseas business finances, or making other significant payments.

AUS/NZ and Asia

UK and Europe